401k 2025 Limits Over 50

401k 2025 Limits Over 50. Every year, the irs sets the maximum 401(k) contribution limits based on inflation (measured by cpi). Anyone age 50 or over is eligible for an additional.

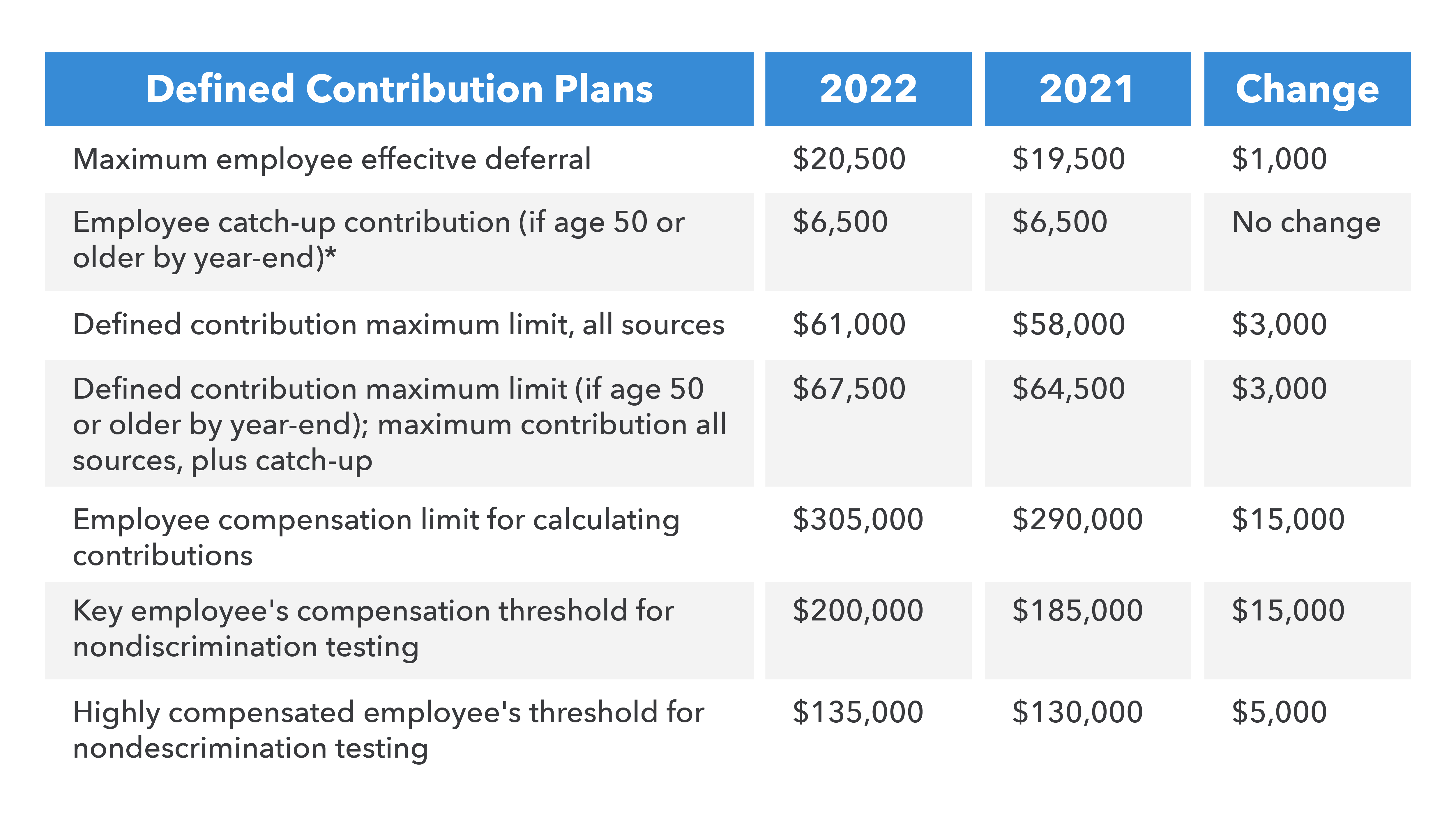

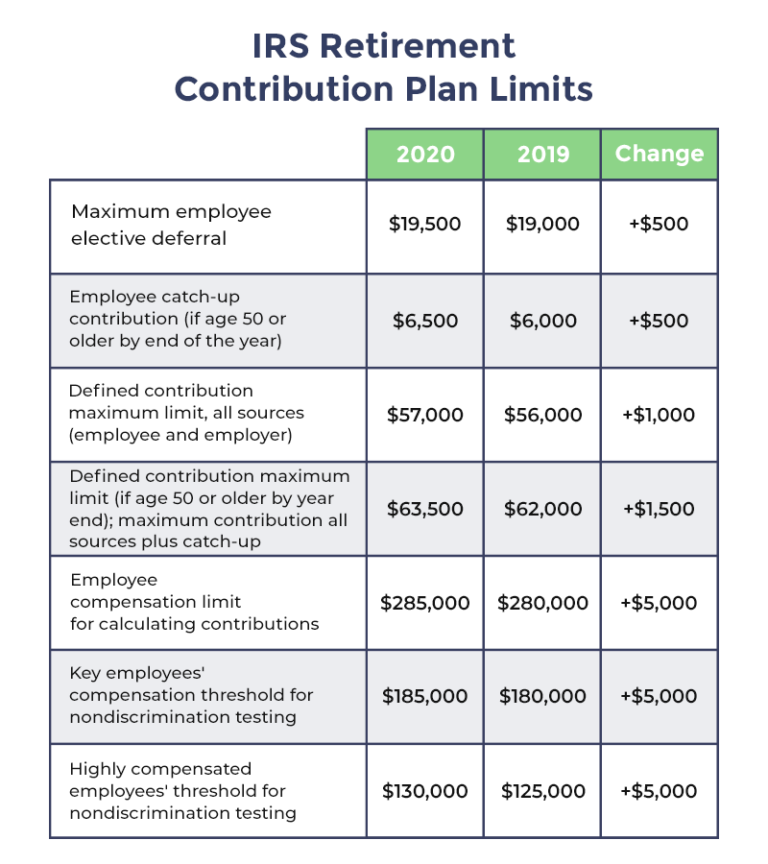

The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation. The 401(k) contribution limits for 2024 are $23,000 for people under 50, and $30,500 for those 50 and older.

These Limits Are Adjusted Annually For Inflation.

This amount is up modestly from 2023, when the individual 401(k) contribution limit was.

The Update Forecasts A $1,000 Boost To This Year’s 401 (K) Elective Deferral Limit Of $23,000, Which Would Bring The 2025 Limit To $24,000.

The 401(k) contribution limits for 2024 are $23,000 for people under 50, and $30,500 for those 50 and older.

The Elective Deferral Limit (The Maximum Amount An Individual.

Images References :

Source: uglybudget.com

Source: uglybudget.com

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, The 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer. The limits apply to both traditional i.r.a.s, which offer a tax deduction for contributions and are.

Source: kierstenwtera.pages.dev

Source: kierstenwtera.pages.dev

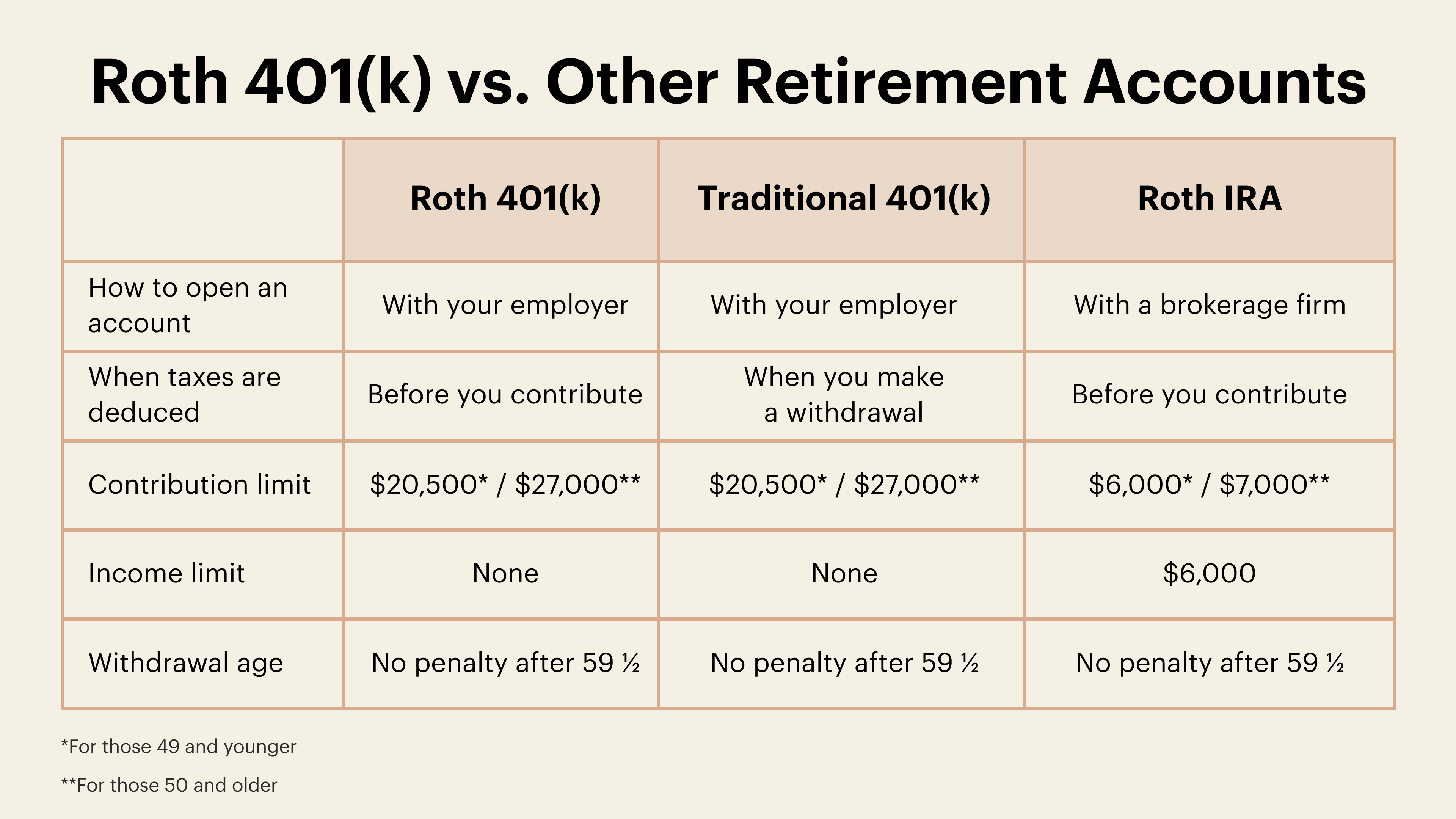

401k And Roth Ira Contribution Limits 2024 Over 50 Gwenni Marena, For 2024, the 401(k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. The 401(k) contribution limits for 2024 are $23,000 for people under 50, and $30,500 for those 50 and older.

Source: kizziewmoyna.pages.dev

Source: kizziewmoyna.pages.dev

401k Catch Up Contribution Limits 2024 Over 50 Kenna Alameda, This amount is up modestly from 2023, when the individual 401(k) contribution limit was. Those who are age 60, 61, 62, or 63 will soon be able to set aside more money in a 401(k) plan.

Source: periaqmeghan.pages.dev

Source: periaqmeghan.pages.dev

Max 401k Contribution 2024 Over 50 Federica, These limits are adjusted annually for inflation. For 2024, the 401(k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The 401 (k) contribution limit is $23,000 in 2024. The 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer.

Source: veronikewgisele.pages.dev

Source: veronikewgisele.pages.dev

Irs 401k Limits 2024 Over 50 Kelli Madlen, Irs 401k 2025 contribution limit the irs sets various limits for retirement plans, including 401(k)s. You can make contributions to a 2024 ira for the current year until the tax filing deadline in 2025.

Source: shawneewklara.pages.dev

Source: shawneewklara.pages.dev

401k Matching Limits 2024 Cyndy Doretta, Defined contribution retirement plans will be able to add an emergency savings account associated with a roth account. The overall 401 (k) limits.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2024 Meld Financial, These limits are adjusted annually for inflation. Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

Source: www.theskimm.com

Source: www.theskimm.com

What Is a Roth 401(k)? Here's What You Need to Know theSkimm, The overall 401 (k) limits. That compares with the $500 boost seen in 2024 over 2023.

Source: berthaqdiannne.pages.dev

Source: berthaqdiannne.pages.dev

Ira Maximum Contribution 2024 Letti Olympia, Irs 401k 2025 contribution limit the irs sets various limits for retirement plans, including 401(k)s. Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

The Limits Apply To Both Traditional I.r.a.s, Which Offer A Tax Deduction For Contributions And Are.

Your total annual contributions — including those made by your employer — cannot exceed 100% of your compensation or $66,000 if you're under 50 in 2023.

Every Year, The Irs Sets The Maximum 401(K) Contribution Limits Based On Inflation (Measured By Cpi).

There are actually multiple limits, including an individual.